Financial management is considered the lifeblood of a business organization. It is “the art of managing money“.

Whether the business concerns are micro-sized or macro-sized, finance management is necessary to fulfill their business activities, and financial managers are people responsible for financial decision-making and achieving financial goals.

What Financial Managers Actually Do?

- Produce financial reports and accounts.

- Direct investment activities.

- Develop strategies and plans for the long-term financial goals of their organization.

Finance managers are mostly focused on developing and monitoring the company’s budget (keeping track of it and establishing a future budget).

Financial managers also keep track of the expenses of the company and ensure they are within the established budget.

Another important responsibility of financial managers is reporting. They must provide accurate and timely reports for the projects after conducting performance evaluations and timely feedback.

Due to technological advancements, the amount of time required to produce financial reports and accounts has been considerably reduced. As a result, financial managers now exercise data analysis much faster for profit-maximizing ideas. Thus, they work in teams, acting as business advisors to the top management.

In addition, it’s imperative for a financial manager to have excellent leadership and communication skills for effective team management and building strong teamwork.

What Are The Major Duties Of A Financial Manager?

Some of the major duties and functions of financial managers include:

- estimating the amount of capital required,

- disposal of profits or surplus,

- determining capital structure,

- choices of sources of funds,

- procurement of funds,

- management of cash,

- utilization of funds,

- financial control.

Almost all government agencies, private firms, and other types of institutions in the US require one or more financial managers. Their duties vary with their specific titles, including credit manager, cash manager, controller, treasurer or finance officer, risk and insurance manager, and international banking manager.

What Is The Average Salary For a Financial Manager in The USA?

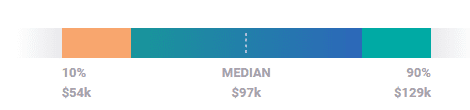

The average salary for a Financial Manager is $96/year (as of 2022). The total cash earnings of the Financial Manager range from $54K to $129K on the high end.

Base Salary | $54k - $129k |

Bonus | $2k - $21k |

Profit Sharing | $1k - $17k |

Commission | $5k - $129k |

Total Pay | $52k - $143k |

In the USA, the job of a financial manager is one of the highest-paid jobs. The Bureau of Labor Statistics estimates that the number of job openings for financial managers will grow up to 15.5% between 2019 and 2029. In this time period, it is estimated for 108,100 jobs to open up.

The best-paid people in the financial management profession live in the metropolitan areas of:

- New York City

- San Francisco

- Connecticut

- Bridgeport…

Requirements For Becoming A Financial Manager In The USA

Financial managers must complete a bachelor’s degree in management, finance, accounting, business administration, or other relevant financial fields.

People with specialized backgrounds, such as a bachelor’s degree in finance, accounting, economics, or business administration, have the easiest time landing jobs. However, many employers now seek master’s degrees.

Many employers prefer that candidates have CPA (Certified Public Accountant) or MBA certifications (Master of Business Administration). They require candidates to have strong analytical skills and to be proficient in the Microsoft Office suite (especially Excel). They must have a high degree of proficiency in working with various financial applications and reporting tools.

Certifications and licensures are common in this field. For example, financial managers working as accountants can become certified public accountants.

Financial managers having 5 or more years of experience in some businesses like loan officers, accountants, auditors, sales agents or financial analysts, are preferred candidates for job openings.

Some companies provide formal management training programs to produce skilled financial managers. Besides working with numbers, financial managers also help members of the association to understand complex reports, which requires significant communication skills.

The Necessary Skills Of Financial Managers

Your career as a financial manager may start at entry-level positions at big associations or banks to become a manager, taking charge of financial oversight duties.

Those who aspire to a Financial Manager profession in the USA need multiple skills:

- interpersonal skills,

- communication skills,

- analytical skills and

- broad understanding of business.

Final Words

Financial managers, before all, MUST be creative thinkers and problem-solvers. They must have knowledge of international finance and regulatory compliance procedures. They help in keeping business operations efficient. Experienced financial managers who have a stronghold of operations of various departments in their organization are promoted to higher positions.

Also, with extensive work experience in this field, the financial manager can start his own consulting firm.

So using every bit of advantage to improve and enhance your performance as a financial manager is a surefire way to financial success.